Smart Beta Top 20 - Systematic Allocation to Digital Assets

Aims at outperforming the market in the medium term allocating to the top 20 cryptos.

A rule-based strategy, targeting top 20 cryptos growth with built-in risk management and volatility control.

Who chooses Smart Beta?

-

Regulated Wealth advisors

Seeking an institutional-grade, easy to integrate, risk-managed crypto allocation solution.

-

Fund of Funds

Allocation to crypto risk premia, designed to capture crypto's growth whilst taming volatitlity.

Key Features of Smart Beta

Diversified Access to Top 20 Digital Assets

Diversify Bitcoin and Ethereum with selected exposure to leading altcoins.

Systematic, Rule-Based Approach

The strategy adapts to changing market conditions in a rule-based maner.

Risk-Controlled By Design

Built-in risk management to limit volatility and drawdowns.

Why Choose a Smart Beta Strategy for Cryptos?

Smart Beta offers an effective way to allocate to cryptos. It combines the low cost and discipline of passive investing with the flexibility and risk management of active strategies.

Unlike allocating to a passive crypto ETF, Smart Beta uses a rules-based, transparent approach to:

✓ Reduce emotional allocation decisions

✓ Avoid overconcentration in a single cryptocurrency, like Bitcoin

✓ Improve diversification across market factors

✓ Adjust dynamically to changing conditions

✓ Target consistent risk-adjusted returns over time

Allocation Process

TameCap Smart Beta is built on a robust, rules-based process. It is designed to deliver strong risk-adjusted returns by actively managing drawdowns.

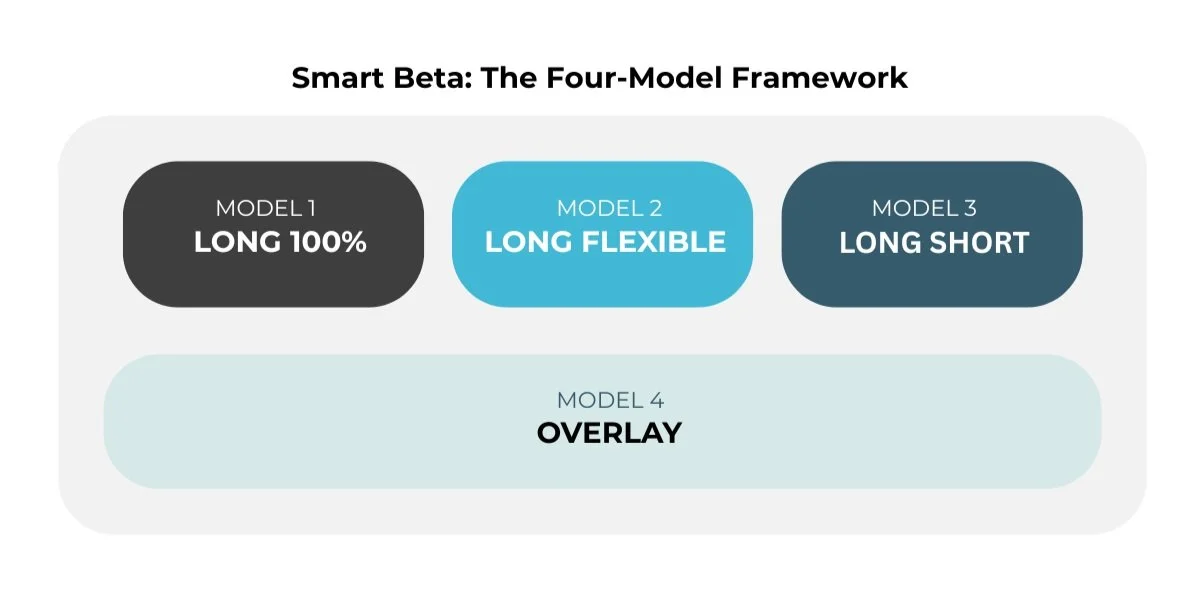

The product rotates between the top 20 cryptocurrencies via 4 models that adapt to shifting market conditions.

Benefits Smart Beta

-

Gain diversified exposure to digital assets through a single, systematically managed strategy — no wallets or manual rebalancing required. Available via AMC (with ISIN) or managed accounts distributed by our regulated partners.

-

Tame Smart Beta fits into a traditional portfolio allocation.

-

Tame Smart Beta is built to weather market cycles — actively managing volatility and significantly reducing drawdowns compared to Bitcoin. It keeps exposure to crypto upside, whilst limiting the extreme downside seen in past market cycles.

-

Quarterly reports and daily exposure updates ensure ongoing transparency.

Proven Performance, Transparent by Design

Tame Smart Beta signals show resiliance across various market cycles: both in backtesting and live implementation since March 2023.

For detailed insights, get in touch or log into the members’ portal.

For informational purposes only – not investment advice

Trusted by our partners

-

Partnership with FINMA, FCA and AMF-regulated investment managers

-

Custody via APLO, an AMF-regulated qualified custodian

-

Parternship with investment managers in various regulated crypto jurisdictions